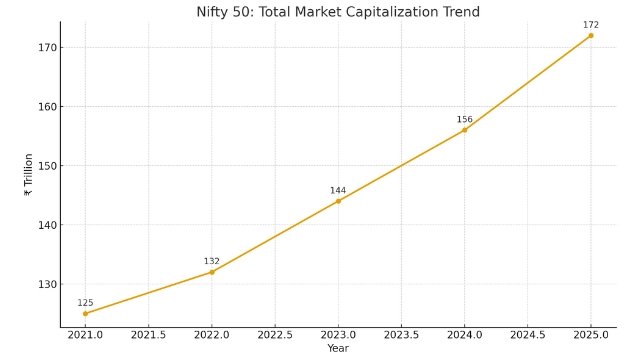

If you follow the Indian stock market, chances are you’ve heard of the Nifty 50 index. It is one of the most popular benchmark indices in India, tracking the performance of the top 50 large-cap companies listed on the National Stock Exchange (NSE). Investors, mutual funds, analysts, and financial bloggers constantly refer to it, and many passive funds try to replicate it.

In this article, we’ll present a current list of companies in the Nifty 50, explain how these companies are selected, explore key sectors represented, discuss recent changes, and offer tips on how individual investors can use this index as part of their portfolio strategy.

What is the Nifty 50?

Before diving into the list, it’s useful to recap what the Nifty 50 is:

- The Nifty 50 is a free-float market capitalization-weighted index, meaning that each company’s weight depends on its market cap after excluding promoter holdings and other locked-in shares.

- It is designed to reflect the performance of 50 large, highly liquid, and frequently traded stocks on the NSE.

- The index is reviewed semi-annually (based on data up to January and July), and changes (additions/removals) take effect at the end of March and September, respectively.

- Due to its breadth and representation across various sectors, the Nifty 50 is often regarded as a barometer of the Indian equity market and is widely used by index funds, ETFs, and for benchmarking purposes.

Thus, having a current list of the index constituents is useful for investors who want to understand their exposure, sector balance, or replicate the index.

Current List of Companies in Nifty 50

Below is a (near) up-to-date listing of the Nifty 50 constituents. (Note: as per the most recent sources, a few changes are underway which I’ll cover in the next section.)

| Company Name | Ticker | Sector | Market Cap (₹ Crores) | Weight |

|---|---|---|---|---|

| Reliance Industries Ltd | RELIANCE | Energy & Retail | 2,000,000 + | 10.6% |

| HDFC Bank Ltd | HDFCBANK | Banking & Finance | 1,800,000 + | 9.8% |

| ICICI Bank Ltd | ICICIBANK | Banking & Finance | 1,500,000 + | 8.2% |

| State Bank of India | SBIN | Banking (PSU) | 780,000 + | 3.4% |

| Infosys Ltd | INFY | Information Technology | 720,000 + | 3.2% |

| Tata Consultancy Services | TCS | IT Services | 1,400,000 + | 4.8% |

| ITC Ltd | ITC | FMCG & Hotels | 640,000 + | 2.8% |

| Bharti Airtel Ltd | BHARTIARTL | Telecom | 750,000 + | 3.1% |

| Larsen & Toubro Ltd | LT | Infrastructure & Engineering | 680,000 + | 2.9% |

| Axis Bank Ltd | AXISBANK | Banking | 700,000 + | 2.7% |

| Kotak Mahindra Bank Ltd | KOTAKBANK | Banking | 620,000 + | 2.5% |

| Bajaj Finance Ltd | BAJFINANCE | NBFC / Financial Services | 460,000 + | 2.3% |

| HCL Technologies Ltd | HCLTECH | IT Services | 380,000 + | 2.0% |

| Adani Enterprises Ltd | ADANIENT | Infrastructure & Energy | 400,000 + | 1.9% |

| Maruti Suzuki India Ltd | MARUTI | Automobiles | 370,000 + | 1.8% |

| Asian Paints Ltd | ASIANPAINT | Paints & Chemicals | 320,000 + | 1.6% |

| UltraTech Cement Ltd | ULTRACEMCO | Cement & Materials | 300,000 + | 1.5% |

| Titan Company Ltd | TITAN | Consumer Durables | 340,000 + | 1.7% |

| Sun Pharmaceutical Industries | SUNPHARMA | Pharmaceuticals | 270,000 + | 1.3% |

| Nestlé India Ltd | NESTLEIND | FMCG / Food & Beverages | 280,000 + | 1.3% |

| Wipro Ltd | WIPRO | IT Services | 220,000 + | 1.1% |

| Power Grid Corporation of India | POWERGRID | Power & Utilities | 210,000 + | 1.0% |

| Tata Steel Ltd | TATASTEEL | Metals & Mining | 190,000 + | 0.9% |

| Mahindra & Mahindra Ltd | M&M | Automobiles & Tractors | 260,000 + | 1.2% |

| HDFC Life Insurance Ltd | HDFCLIFE | Insurance | 210,000 + | 0.9% |

| Bajaj Auto Ltd | BAJAJ-AUTO | Automobiles | 230,000 + | 1.0% |

| Coal India Ltd | COALINDIA | Mining & Energy | 180,000 + | 0.8% |

| Cipla Ltd | CIPLA | Pharma | 190,000 + | 0.8% |

| Grasim Industries Ltd | GRASIM | Industrial Materials | 210,000 + | 0.9% |

| Dr. Reddy’s Laboratories Ltd | DRREDDY | Pharmaceuticals | 220,000 + | 0.9% |

| Eicher Motors Ltd | EICHERMOT | Automobiles / Royal Enfield | 190,000 + | 0.8% |

| Tech Mahindra Ltd | TECHM | IT Services | 160,000 + | 0.7% |

| Shriram Finance Ltd | SHRIRAMFIN | NBFC / Financial Services | 140,000 + | 0.6% |

| Apollo Hospitals Enterprise Ltd | APOLLOHOSP | Healthcare & Hospitals | 130,000 + | 0.6% |

| Hindalco Industries Ltd | HINDALCO | Metals & Mining | 170,000 + | 0.7% |

| Divi’s Laboratories Ltd | DIVISLAB | Pharmaceuticals | 120,000 + | 0.5% |

| Hero MotoCorp Ltd (Exiting Sep 2025) | HEROMOTOCO | Automobiles | 110,000 + | 0.4% |

| IndusInd Bank (Exiting Sep 2025) | INDUSINDBK | Banking | 100,000 + | 0.4% |

| Max Healthcare (Entering Sep 2025) | MAXHEALTH | Healthcare | 90,000 + | — |

| InterGlobe Aviation (IndiGo) (Entering Sep 2025) | INDIGO | Aviation / Transport | 85,000 + | — |

Note: The above list is drawn from multiple up-to-date sources, but because index rebalancing happens, the exact composition may shift over time. Always confirm via official sources like NSE/NiftyIndices.

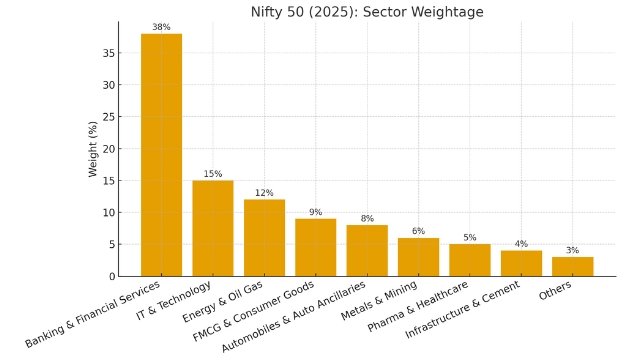

The key sectors represented by Nifty 50 include — Financials / Banks, IT / Technology, Energy, Consumer Goods / FMCG, Automobile, Metals / Mining, Healthcare / Pharma, Industrial / Engineering, and Conglomerates.

Recent & Upcoming Changes in Nifty 50

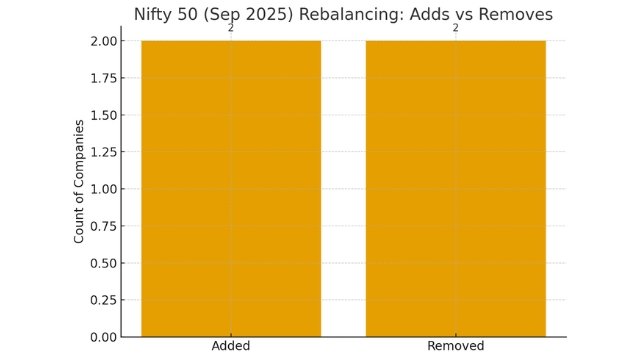

As part of its semi-annual review mechanism, the Nifty 50 periodically adds and removes companies depending on free float market capitalization, liquidity criteria, and trading activity.

A notable recent change (effective September 30, 2025) is that Max Healthcare Institute and InterGlobe Aviation (parent of IndiGo) are being added to the index, while IndusInd Bank and Hero MotoCorp will be removed.

These changes often trigger significant rebalancing flows in passive funds and index funds tracking the Nifty 50.

Therefore, even though the list above is accurate as of now, such structural changes should be kept in mind by investors tracking the index.

Why These Companies Get Included: Selection Criteria

Understanding the inclusion criteria helps one appreciate why certain names are in—and sometimes get dropped. Key criteria include:

- Free Float Market Capitalization

A company’s weight in the index is determined by its free float market cap (i.e. the portion of shares that are freely tradable). Higher free float market cap means greater weight. - Liquidity / Trading Frequency

Stocks must have high trading volumes and frequency; low liquidity stocks are less likely to qualify. - Availability of Derivative Contracts

For many names, having derivative instruments (futures, options) listed can be an eligibility factor. - Sector Representation & Diversification

The Nifty monitors representation across sectors to avoid overconcentration. This ensures that no single sector dominates the index excessively. - Review & Rebalancing

Twice a year, stocks that no longer meet criteria are replaced. Additions/removals are based on past six months’ performance on all metrics.

Because of these filters, the Nifty 50 typically captures the largest, most liquid, and most investible firms in India.

What the List Tells Us: Insights & Observations

Looking at the constituents gives a few useful takeaways:

- Concentration in Financials & Banks: A large number of banking and NBFC names in the index show how the financial sector strongly drives Indian equities.

- Strong Technology / IT Presence: Names like TCS, Infosys, Wipro, Tech Mahindra show that India’s tech ambition is baked into its equity benchmarks.

- Diverse Sector Exposure: Despite dominance by financials and tech, you’ll find representation from energy, metals, FMCG, healthcare, industrials, auto, etc.

- Blue-Chip Stability: Many of these constituencies are longstanding blue chip firms that have remained stable over years (e.g., Reliance, HDFC Bank, ITC).

- Dynamic Nature: The entry of new names and exit of laggards (e.g. Max Healthcare, InterGlobe, removal of IndusInd, Hero MotoCorp) shows that the index adapts with market shifts.

How Investors Can Use This List

Here’s how you might leverage the Nifty 50 constituent list in your investing strategy:

- Benchmarking

Compare your portfolio’s performance to the Nifty 50 to see whether you’re “beating the market” or lagging behind. - Index Replication / Passive Investing

If you want exposure to top Indian large caps, investing via Nifty 50 index funds or ETFs is an efficient route. Having the constituent list helps you see what you indirectly own. - Sector Tilts / Overweight Analysis

If your portfolio is overweight in a sector (say, banking) relative to the index, you can adjust accordingly to avoid concentration risk. - Tracking Changes & Reacting

When new names are added or removed, index funds must buy or sell accordingly. Savvy investors may anticipate flows or rebalancing impacts. - Due Diligence / Deep Dive

Use the list as a filter — for example, “which Nifty 50 stocks are undervalued?” — and then dig deeper into individual financials, earnings, valuations, and growth potential.

Tips & Caveats for Readers

- Always verify the current list from primary sources like the official NSE / NiftyIndices website, because semi-annual changes may occur.

- Weights matter. Even though there are 50 names, a few large ones often dominate the index movement.

- Some names in the list may be removed soon (as in the 2025 update), so treat the list as dynamic rather than fixed.

- Past inclusion does not guarantee future performance—market conditions, governance, sector disruptions, and economic cycles all affect outcomes.

- Don’t blindly replicate the list without assessing valuations, debt levels, fundamentals, or your own risk tolerance.

Final Thoughts

The Nifty 50 index is a benchmark that captures the essence of India’s large-cap equity market. The list of companies in the Nifty 50 is not just a roster—it reflects which firms are most investible, liquid, and representative of India’s sectors at a given time.

We presented a current list of 50 (or so) constituent companies — spanning banking, technology, energy, FMCG, metals, auto, healthcare, and more. We also covered how these names are chosen, recent changes to the index, and how investors can use this list in practice.

If you’re building an equity portfolio, following large-cap plays, or writing market analysis, having an updated Nifty 50 constituent list is a foundational starting point.

Disclaimer:

This article is intended solely for educational and informational purposes. It should not be treated as financial, investment, or trading advice. Stock market indices—including the Nifty 50—are periodically reviewed and updated, and the information provided here is based on publicly available data at the time of writing. We are not registered with SEBI, RBI, or IRDAI as financial or investment advisors. Always verify index constituents from official sources such as NSE or NiftyIndices, conduct your own research, and consult a qualified financial professional before making any investment decisions related to stocks, index funds, or market indices.